Most Australians have their wealth tied up in the family home and Superannuation. For a fortunate few, wealth outside the family home and Superannuation can be considerable.

The responsibility you carry to manage these assets wisely should not be underestimated. Not just for your own future well-being but potentially for the generations coming who could benefit as well. LifeTime Financial Group recognises the gravity of this responsibility and to that end has developed a Directly Held Investment Portfolio service that is both accountable and auditable and is professionally managed on an ongoing basis.

What is a Directly Held Investment Portfolio?

A Directly Held Investment Portfolio is a bespoke portfolio of investments, created specifically for you. Held in either personal name/s or via a trust or corporate structure depending on the circumstances.

How does LifeTime Financial Group manage your investments?

Investments

The Directly Held Investment Portfolio can hold all types of investment including direct property, Cash, Australian and overseas stocks and Exchange traded funds etc.

Wrap Management

To facilitate accurate reporting, we use proprietary software that allows us to manage and report on a broad range of assets including equities, direct property you already own, exchange-traded funds, preference shares/hybrid fixed interest investments, term deposit arrangements, and cash management account including high yield at call accounts. It is important to note all assets are physically held in the name of the entity rather than as Custodian. This means the assets are yours (Or the entity's) and yours alone.

The Cash Hub

All transactions are managed by LifeTime Financial Group through the cash management account. You have full access to this cash hub account ensuring complete transparency. We ask that you never transact yourself on the cash account. Rather, if you require an additional transaction, simply advise us, and will facilitate it immediately for you. This ensures all transactions are accurate and accounted for.

There are a range of transactions that occur in the cash management account on an ongoing basis. Dividends paid in from shares, our fees, additional funds invested or withdrawn as directed by you, etc.

Minutes

Preparing and filing minutes whenever a decision is made ensures all transactions are both approved and understood.

Regular Reporting

Regular monthly reporting of both your holdings and the cash management account ensures you are always up to date. You are also able to access the information online at any time. Account balances, holdings, portfolio valuations, and performance, etc.

To assist with the preparation of an accurate and timely tax return, we produce an export file your accountant can import to their systems, making it a quick and easy process for everyone involved.

The benefits....

- Twice-yearly review meetings

- revisit your gaols and an ideal time to make fine adjustments to your ongoing investment strategy

- A single point of contact for all your investment needs

- you can take comfort in knowing the adviser you currently have a relationship with will play an ongoing role in the administration of your portfolio

- Proactive management of your portfolio - your investment portfolio is monitored on an ongoing basis and where appropriate, recommendations are made.

- Your twice-yearly review measures your portfolio against your personal Investment Strategy to ensure continuing matching of your risk preferences with your holdings

- High Yeilding cash accounts

- available to park excess cash in the shorter-term

- Reduced paperwork

- we can receive and manage all documentation relating to your investments (such as share trades, dividend, and interest payment advice, etc.) if LifeTime Financial Group's address is nominated to receive all notices

- online access to our filing system to view these statements if required

- Transparent reporting

- our service provides you with regular reports to help monitor your portfolio valuations

- Stress-free tax preparation

- A comprehensive tax report is prepared for your Accountants.

- We can liaise directly with your Accountant if you prefer to make this process even more stress-free

- 24-hour access to your portfolio

- you have 24-hour online secure web access to your portfolio details with 20-minute delayed price updates for listed investments.

- Ease of cash transacting - third party payments can be arranged for you at no cost

- Simply email us with the amount and payment details and we can arrange for payment of same.

- You will need to enter an SMS code to confirm the transaction

- Your Wealth+ fees may be tax deductible - for most investors, the ongoing portfolio management fees are tax-deductible

Who can benefit from the use of a Directly Held Investment Portfolio facility?

Whilst individuals and families utilise this structure to invest accumulated wealth, Corporate clients and Testamentary Trusts are some of our largest investors.

Corporate entities find this a very attractive method for managing larger amounts of cash. Corporate structures can accumulate significant holdings for many reasons. Perhaps the most common strategy is to draw down dividends post-retirement. The tax benefits of this strategy can be considerable.

Intergenerational wealth, managed through a corporate structure can reduce the impacts of CGT by potentially avoiding the need to transfer ownership from one generation to the next. Like all planning, this requires considered, detailed analysis to ensure this approach best suits you and your family's needs. Intergenerational corporate structures are not generally appropriate for account balances of less than $5,000,000.00

LifeTime Financial Group has been managing the needs of wealthy entities since 1987 and brings a wealth of experience to our clients.

The primary benefits include;

- the opportunity to earn better than cash rates without tying up your capital unnecessarily

- commence a drawdown of income when it suits you

- invest your funds according to your personal/corporate preferences

- have the funds managed professionally with full reporting and online access

- full annual reporting to your accountants making reporting significantly easier for you

- transparent and highly competitive cost structures

How much will this cost me?

The simple answer is less than you think.

Whilst most platforms charge a fee based on a percentage of Funds under management, LifeTime Financial Group offers a highly competitive fee structure for ongoing management of and reporting on your investments. Our fees are often less than half of what a wrap platform charges.

There is also an ongoing advice and guidance fee. You may have come across an adviser service fee if you have used the services of a planner in the past. These are generally set at 1.1% of Funds under management by most advisors rather than on the work anticipated. Again, our costs are based on reasonable time expectations and are competitively priced.

Our overall cost structure (Ongoing advice and guidance and management of the investments) is very cost-effective and can be less than platform costs (which don’t generally include advice). In most cases, our ongoing fees are deductible making them even more competitive.

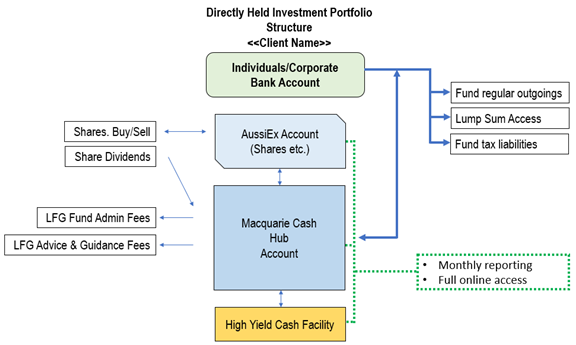

What does a Directly held investment portfolio look like?

Typically, our clients will have a structure through which the entity invests. There are many variations in use by our clients. They include Discretionary trusts, Companies or simply individual investors. Regardless of the structure, the LifeTime Directly Held Investment Portfolio can be tailored to your needs.

The service includes

- a cash hub managing all inflows and outflows,

- a trading facility allowing for investments in equities, exchange-traded funds, and hybrid fixed interest assets (See more information on our stock broking services here) and

- an online banking portal enabling us to manage excess cash by ensuring those funds are always placed to receive competitive rates without having to complete the 100 points check each time you need to move funds from one bank to another.

Why not take the next step and talk to a qualified and highly experienced financial planner today?

LifeTime Financial Group are specialist (holding appropriate accreditations) advisors who are ideally positioned to assist you in planning and managing you and your family's personal wealth needs.

If you would like to discuss your current position or wider financial planning needs, why not call us today on 03 9596-7733? There is no cost or obligation for our initial conversation/meeting.

LifeTime Financial Group. A leading privately-owned Melbourne-based Financial Planning practice with no ties to any financial institution.