- Published on 30 Mar 2023

- - What is Financial Planning?, Self Managed Superannuation, Directly Held Investment Portfolio, Investment & Financial Advice

A client was kind enough to send me an interesting article following a detailed conversation on their portfolio and their concern about the Credit Suisse (CS) impact on Australian Hybrids for good reason. As we favour hybrids within a client portfolio and just about all our clients hold them, I thought I should share this with you.

Written by Jason Lindeman of Coolabah Capital (20/03/2023), he compares Australian V/s. European assest as follows:

Aussie banks are widely regarded as being the safest and most liquid on the planet, and we have seen a "flight to quality" as global investors shift out of riskier bank securities into gold-standard institutions like the four majors. Aussie bank bonds have, therefore, materially outperformed their peers during these events.

It is important to note that the CS hybrids---and European hybrids more generally---are radically different to Aussie bank hybrids for many reasons, including:

- Government bail-outs of risky banks in Europe are relatively common, and these write-offs of hybrids etc have occurred in many cases, such as Cyprus (2013), Austria (2014-2016), Denmark (2016), Greece (2009-2015), Netherlands (2013), Portugal (2016), Slovenia (2013), and Spain (2012 and 2017);

- In a government bail-out, the CS hybrids had to be automatically zeroed and written-off completely (they were not allowed to be converted into equity);

- The CS hybrids do not allow for any partial write-down---only a full write-down is permitted, which means they had to wear a 100% loss;

- The CS hybrids carry a very low, junk-level credit rating of single "B" from S&P, which signals their high risk of default compared to investment-grade securities; and

- The CS hybrids were not listed on a stock market, but rather traded in the much more opaque over-the-counter market.

In contrast, Aussie bank hybrids have many fundamentally different features:

- No Aussie bank/insurer bond or hybrid has ever been bailed-in or written-off in contrast to the European bank experience, where this has happened regularly;

- In the UK and Europe, banks have also stopped paying coupons (income) on hybrids, and regularly miss their first optional call/repayment dates. No Australian bank/insurer has ever missed a coupon payment and they commonly refinance their hybrids on their first available call date;

- Aussie major bank hybrids are highly rated compared to peers at an investment-grade BBB- level by S&P, which is much stronger than the CS hybrids' junk rating;

- In the event of a bank failure requiring a government bail-out, Aussie bank hybrids convert into ordinary equity, diluting down shareholders, rather than being written-off;

- This conversion can be partial or full depending on how much fresh equity capital the bank needs, which means that the regulator (APRA) may not need to fully convert all the hybrids into bank equity;

- Write-off only becomes an option if equity conversion is not possible, but bank/insurer issuers of Aussie hybrids secure board approval for all the equity conversion requirements, and associated issuance of new shares, at the time they launch the hybrid; and

- Aussie hybrids are almost all traded on the transparent ASX, and characterised by very high levels of liquidity with over $9 billion trading since 1 January 2022.

More fundamentally, the Aussie banks carry much higher credit ratings than most European peers, including CS, and are generally considered much safer institutions. A few notable attributes include:

- The major Aussie banks are rated AA- by S&P, miles above CS's rating of only BBB-;

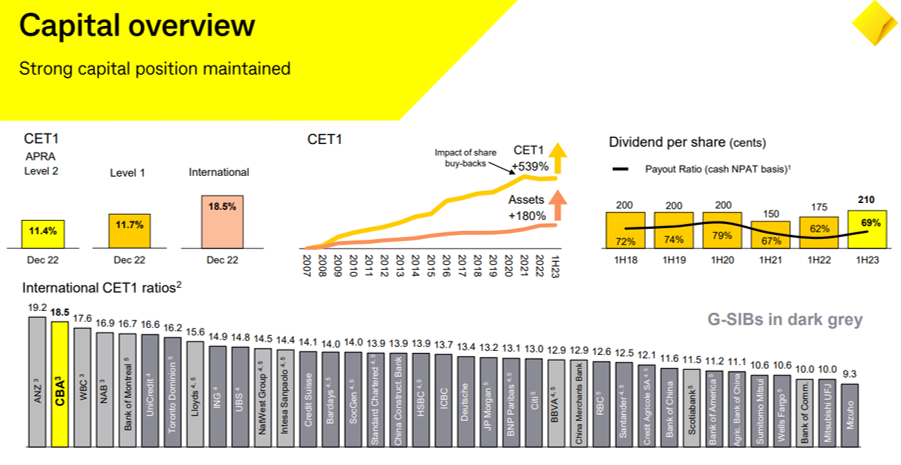

- Aussie banks carry substantially more core equity capital than CS (see chart below), and therefore a lot less leverage;

- Aussie banks are subject to much stricter liquidity rules than US and European banks, and are only allowed to hold government bonds for their high quality liquid assets (rather than, for example, the bank-issued covered bonds and residential mortgage-backed securities that US/European banks commonly use as a substitute for government bonds);

- Aussie banks have much safer and simpler business models, which are geographically limited to Australia and NZ, and focussed on basic savings and loans to businesses and households with few if any exposures to riskier foreign markets or complex trading activities;

- In contrast, CS comprised of a retail bank, a large global investment bank, a global asset management business, and a huge global wealth advice business, which consistently found itself caught up in scandals related to its riskier activities.

Current hybrid yields

We are responsible for managing BetaShares' active hybrid ETF, ASX: HBRD, which was one of the best performing liquid fixed-income ETFs in the world in FY22. In contrast to some of its Aussie ETF peers, HBRD has zero exposure to CS hybrids, or any European or US bank hybrids: we have been exclusively focussed on Aussie bank/insurer bonds and hybrids.

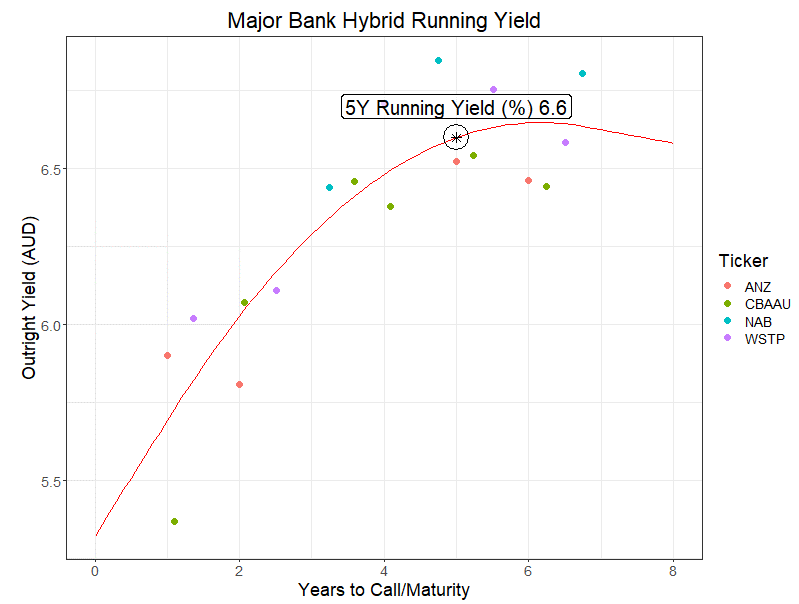

Because we had felt that Aussie bank hybrid spreads had become quite tight---with the major bank 5-year spread falling as low as 2.2% above the quarterly bank bill swap rate (or a total running yield of about 5.9% including franking)---we had lowered HBRD's portfolio weight to hybrids from 99% in 2022 to as low as circa 74%. Instead of holding hybrids, HBRD bought more attractive senior bank bonds and Tier 2 bonds, which have accounted for 21% of the portfolio. Unsurprisingly, ASX major bank 5-year hybrid spreads have been drifting wider for a few months, moving up from 2.2% over the bank bill swap rate to about 2.9% over today. That means the all-in running yield has lifted from about 5.9% pa to circa 6.6% right now, which is obviously more appealing.

The chart below shows the current running yields available on the major banks' ASX hybrids.

EU regulators have come out and stated they would never allow AT1 hybrids to be bailed-in before all bank equity is wiped out:

The Single Resolution Board, the European Banking Authority and ECB Banking Supervision welcome the comprehensive set of actions taken yesterday by the Swiss authorities in order to ensure financial stability. The European banking sector is resilient, with robust levels of capital and liquidity.

The resolution framework implementing in the European Union the reforms recommended by the Financial Stability Board after the Great Financial Crisis has established, among others, the order according to which shareholders and creditors of a troubled bank should bear losses.

In particular, common equity instruments are the first ones to absorb losses, and only after their full use would Additional Tier 1 be required to be written down. This approach has been consistently applied in past cases and will continue to guide the actions of the SRB and ECB banking supervision in crisis interventions.

Additional Tier 1 is and will remain an important component of the capital structure of European banks.