- Published on 23 Aug 2017

- - Investment & Financial Advice

At times in the past, we have been asked by our clients why we diversify investments across separate asset classes when making investment recommendations.

Particularly when one asset class is significantly outperforming another.

When we consider a clients appetite for risk, we allocate funds to assets including Cash, Fixed interest (preference shares, bonds etc.) Australian and International Equities and Property.

Vanguard provides LifeTime Financial Group with a range of exchange traded funds we regularly use when constructing our portfolios. They also have a range of illustration tools that are really helpful when discussing investments generally.

I have to say one of my favourite tools is the Asset Class Tool on their website (Click here)

This tool is ideal because it creates a visual table of each sector available to investors (with the ability to exclude sectors if you would like to) and identifies the performance of those sectors over any time frame from one year all the way back to 1970. And best of all, it's completely free to use.

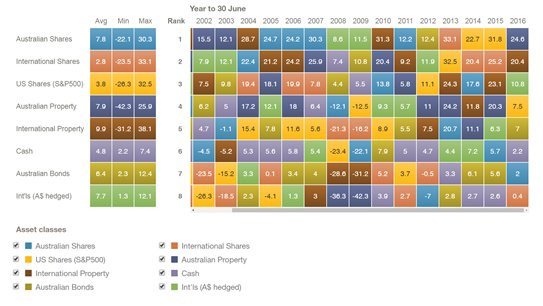

The table splits into two sections with returns on a year by year basis on the right (Sorted in columns). On the left is a summary table which colour codes each sector.

In the image below we can see Australian Shares in a steely blue, the US Shares S&P500 in an orangey yellow etc.

Between the two columns, we can see a ranking. In each column, the top performing sector is at the top and the list moves down.

- In 2016 we can see Australian property was ranked #1, international property # 2 and so on. In 2015, Australian property was ranked 4 and International property, 3.

- In 2015, the S&P500 is ranked # 1 but in 2005, it was ranked last at # 8.

- Australian shares were ranked # 1 in 2005, 2006 and 2007 but the slipped to # 4 in 2008 and # 6 in 2009.

The point to this table is that no one sector remains at the top. In fact, they move around considerably creating a colourful tapestry.

The reality is that no one person can consistently pick what is going to be the next # 1 Investment and to that end, diversification is incredibly important to the smoothing out of your overall portfolio’s performance.

In the example I include in this article, I note the following:

- Australian shares average 7.8% for the period selected (I have selected the period from 01/07/2000 to 30/06/2016. You can't see 2000 and 2001 in the table because the table itself needs to scroll!). swing between 30.30% in one year to -22.10% in another.

- Australian has swung between -42.30% to 25.90% and averaged 7.9%

- International Equities are averaging 2.8% but have swung between -23.50% and 33.10%.

I hope you have found this table as interesting as I have.

LifeTime Financial Group is a boutique financial advisory firm whose specialist advisors (holding appropriate accreditations) are ideally positioned to assist you with a wide range of investment advice and guidance needs.

Would you like to discuss your personal position further with one of our highly qualified financial planners? Why not call us today on 03 9596-7733. There is no cost or obligation for our initial conversation/meeting.

Written by Anthony Stedman of LifeTime Financial Group. LifeTime Financial Group is an award winning and privately owned Melbourne based Financial Planning practice specialising in managing the financial affairs of busy wealthier Australians.