- Published on 29 Sep 2023

- - What is Financial Planning?, Self Managed Superannuation, Superannuation

Retirement planning is a topic close to everyone's heart, but there's no one-size-fits-all answer to the question of when to retire. It's a deeply personal decision that hinges on various factors, including your financial situation, goals, and lifestyle expectations.

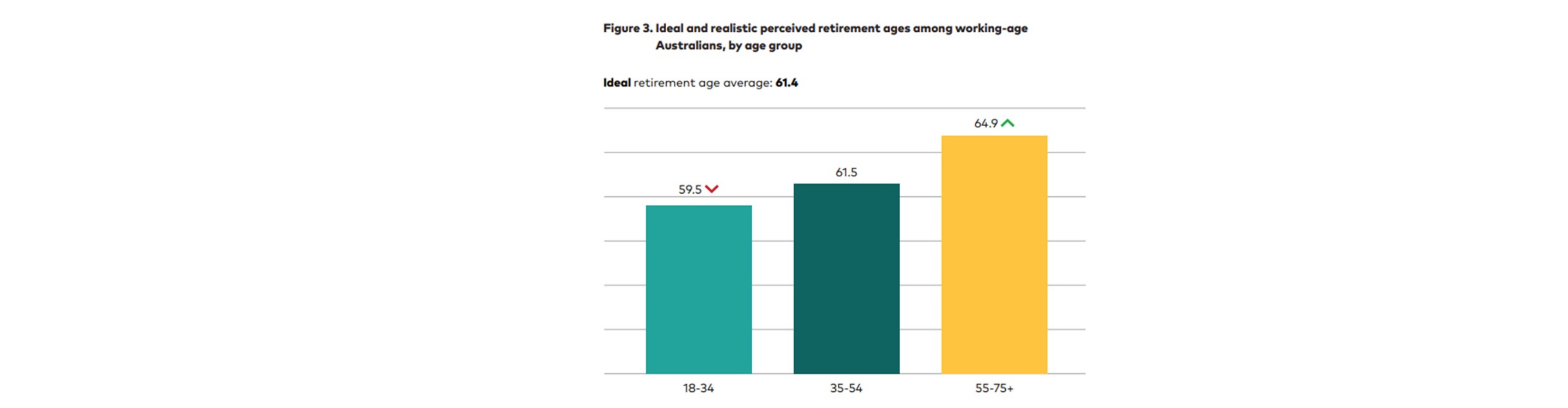

Vanguard Australia has recently unveiled its comprehensive report, titled 'How Australia Retires.' This insightful research delves into various aspects of retirement, shedding light on intriguing findings. Among the wealth of data, one particular revelation caught our attention: the perspectives on the ideal retirement age across different age groups.

This pivotal question, "What is the ideal retirement age?" was posed to individuals spanning various stages of their working lives. The respondents were then categorised into three distinct groups based on their age: the first group encompassed those aged 18 to 34, the second group consisted of individuals aged 35 to 54, and the third group encompassed those aged 55 and above.

The outcomes of this study delivered a crystal-clear message: the younger the individual, the earlier they envisioned the ideal retirement age to be. To illustrate this trend, Vanguard's report featured a revealing graph.

The Financial Equation

Your financial readiness plays a pivotal role in determining your ideal retirement age. Take stock of your savings, investments, and pension plans. Consider factors like your mortgage, debts, and monthly expenses. A clear financial snapshot will help you gauge when you can comfortably leave the workforce.

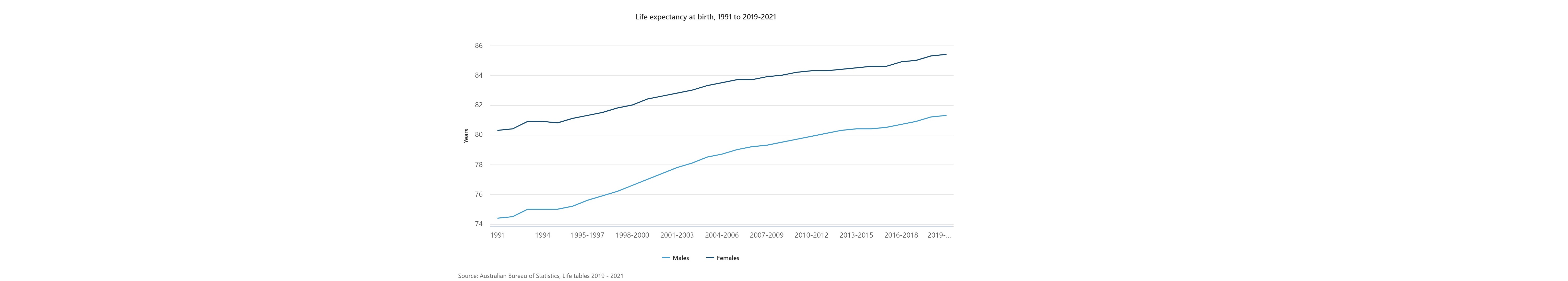

Life Expectancy

Australia boasts one of the highest life expectancies globally, which means you may enjoy a long retirement. It's crucial to ensure your retirement savings can support you throughout your post-work years. The longer you plan to live in retirement, the more you'll need in your nest egg.

Superannuation and Age Pension

Your superannuation and the age pension are integral components of your retirement income. Understanding the eligibility criteria and payout options can be complex, but they significantly impact your retirement age decision. Consulting a financial advisor, like those at LifeTime Financial Group, can provide clarity on how to maximise these benefits.

Lifestyle Aspirations

Retirement isn't just about finances; it's also about lifestyle. Consider your dreams and aspirations for your retirement years. Do you want to travel the world, take up new hobbies, or enjoy a peaceful life at home? Your retirement age should align with your vision for the future.

Health Considerations

Your health plays a pivotal role in determining when to retire. Some may wish to retire earlier due to health concerns, while others may choose to work longer if they're in good health. Be sure to assess how your health may factor into your retirement plans.

Embrace Flexibility

Ultimately, the ideal retirement age is a moving target. Life circumstances change, and so can your retirement plans. Embrace flexibility and regularly review your financial situation, goals, and aspirations. Adjust your retirement age accordingly to ensure a secure and fulfilling retirement.

In conclusion, there's no universal answer to the question of when to retire. It's a decision influenced by your finances, life expectancy, government benefits, lifestyle goals, and health.

Why not take the next step and talk to a qualified financial planner?

LifeTime Financial Group are specialist (holding appropriate accreditations) advisors who are ideally positioned to assist you with your Retirement planning requirements.

If you would like to discuss your wider financial planning needs, why not call us today on 03 9596-7733? There is no cost or obligation for our initial conversation/meeting.

Alternatively, please make an appointment using our online Book an appointment (Blue button above)

LifeTime Financial Group. A leading privately-owned Melbourne-based Financial Planning practice with no ties to any financial institution.