- Published on 27 Aug 2021

- - What is Financial Planning?, Self Managed Superannuation, Investment & Financial Advice, Investor Retirement Visa

A bit of background

A retired client called me today about this offer. They are retired and have no assessable income having sold their last investment property in the last financial year. They are both in their late 60's which means SAPTO rules apply.

Their holdings are modest but my clients are always looking for a decent return on their direct equities investments.

Woolworths has announced a #2B off-market buy-back program

After the great year Woolworths has had, they have found themselves in a position where they are offering a $2B off-market buy-back of shares. Off-market buy-backs are a tax-effective mechanism for returning franking credits to shareholders who value these the most.

Sharecafe has prepared a concise summary that accurately summarises the position my clients are in. I thought I should share this with you.

The buy-back will have a $4.31 capital component, with the balance being a fully franked dividend. The buy-back will be based on a tender, with investors tendering to sell shares at a discount of between 10% to 14% below market price. Shareholders who don’t participate will still benefit from the buy-back to the extent that shares are effectively bought back at a cash discount to market price. This compares with on-market buybacks, where companies buy-back stock at market price.

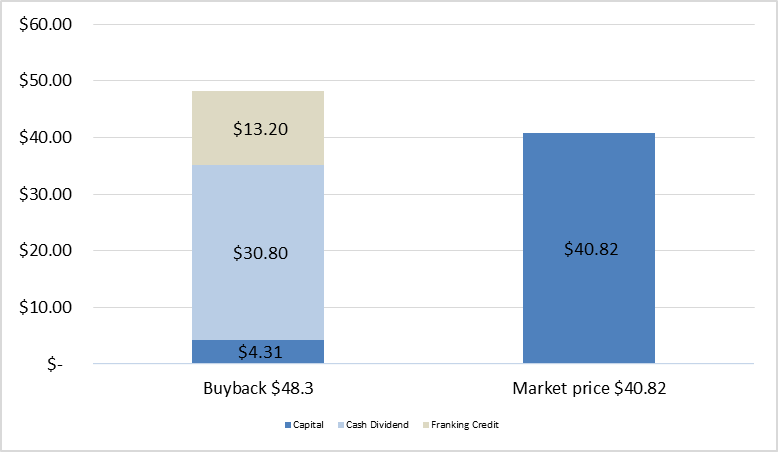

We have analysed the value of the buy-back for tax-exempt investors such as charities, foundations, pension phase superannuation and individuals below the income tax threshold using the market price of Woolworths on August 25 of $40.82 – see Chart 1 below. Using $40.82 as a guide (the actual price used for the buy-back will be the volume-weighted average price of Woolworths shares in the five trading days up to and including October 15, 2021) the maximum 14% discount would equate to a $35.11 buy-back price. With the capital component being $4.31, the other $30.80 would represent a fully franked dividend, which would have a $13.20 franking credit attached. For a tax-exempt Australian investor, we estimate the buy-back at a 14% discount would be worth approximately $48.30 (disregarding the time value of money), representing an after-tax profit of $7.48 or 18% compared to the market price of Woolworths today. Please note that the buy-back is expected to be completed on October 18, 2021, based on volume-weighted prices from the previous week.

Chart 1. The estimated value of the Woolworths buy-back for tax-exempt investors.

Source: Plato, Woolworths buy-back announcement 26 August 2021.

Do you have a question relating to this offer or any other financial planning inquiry? Why not take the next step and get in touch?

LifeTime Financial Group is a firm of specialist advisors (holding appropriate accreditations) who are ideally positioned to assist you in planning for your financial future.

Call us today on 03 9596-7733? There is no cost or obligation for our initial conversation/meeting.

LifeTime Financial Group. A leading privately-owned Melbourne-based Financial Planning practice with no ties to any financial institution.