- Published on 31 May 2021

- by Anthony Stedman

- - What is Financial Planning?, Self Managed Superannuation, Transition to Retirement

Key dates relating to the Covid reduction in minimum age-based percentage factors

- 22 March 2020. The Federal Government announced it would reduce the minimum pension draw-down rates would be cut in half on a temporary basis.

- 29 May 2021. The Federal Government has announced it will continue to allow retirees to draw down 50% of the standard draw-down rates usually used.

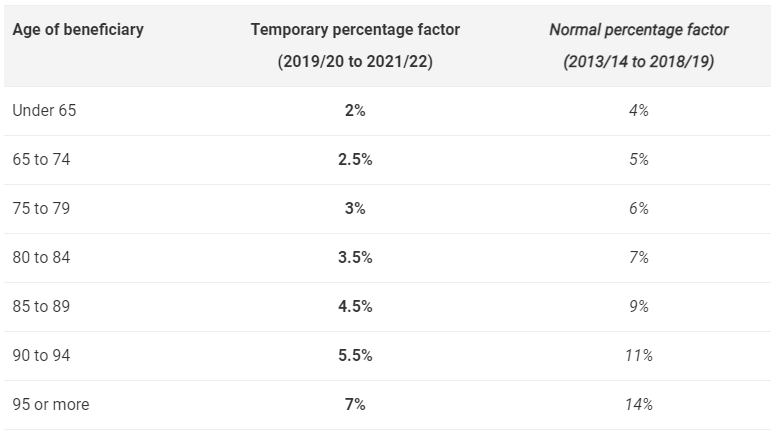

The rates noted below reflect the Federal Governments' temporary reduction in Pension drawdowns for the 2019/20, 2020/21, and 2021/22 financial years.

Source: SIS Act

When a Pension commences, the opening balance on July 1 of each year is used to arrive at the minimum drawdown required to meet the requirements.

Working example

Ava is aged 68 and has an opening balance on July 1, 2020, of $1,000,000 in Pension Phase. Ordinarily, she would be required to draw down a minimum of 5% of her balance ($50,000 in the financial year). Under the continuation of the Covid reduction announced on 22/03/2020, Ava can draw down a minimum of $25,000 or 2.5% of the opening balance on July 1, 2020. This allows Ava to retain more money in her Pension for her benefit in the future

Who will benefit from this continuation?

All retirees with Account-Based Pensions could benefit from this continuation. Lyn Formica, head of technical and education services at SMSF Specialist Heffron notes the legislation (passed on March 24) made it clear that this includes allocated pensions and market-linked pensions (also called term allocated pensions), as well as transition to retirement pensions.

Not included are defined benefit pensions such as lifetime or life expectancy products

Those who don't require the full income mandated by the normal percentage factor have the opportunity to continue at lower Pension income stream amounts. Equally, those who suffered a downturn in their funds will be afforded the time to ride out this period of instability in the markets without having to potentially sell assets at a loss to meet their minimum drawdown. This allows clients to retain more money in the market and benefit from the inevitable upswing.

Why not take the next step and find out how the extension to this could benefit you?

LifeTime Financial Group are specialist (holding appropriate accreditations) advisors who are ideally positioned to assist you in planning for your financial future.

If you would like to discuss your current Pension position, why not call us today on 03 9596-7733? There is no cost or obligation for our initial conversation/meeting.

LifeTime Financial Group. A leading privately-owned Melbourne-based Financial Planning practice with no ties to any financial institution.

Related News & Cases

- Early Retirement Planning: The Key to Future Financial Comfort / Dec 2025

- The Cost of Timing the Market | Why Staying Invested Builds Long-Term Wealth / Oct 2025

- Government announces major redesign of proposed $3 million superannuation tax (Div 296) / Oct 2025

- Wealth Transfer and Estate Planning in Australia. Key Strategies for Families / Sep 2025

- Aged Care Advice | Financial Planners in Brighton, Melbourne / Sep 2025

- LifeTime Financial Group | Bayside’s Highest Rated Financial Planners / Aug 2025

- Good Debt vs. Bad Debt: Understanding the Differences and Managing Wisely / Jul 2024

- Building Your Golden Nest Egg: A Strategic Guide to Retirement Planning / May 2024

- Navigating Division 293 Tax / Mar 2024

- Understanding Changes to Superannuation Contribution Caps in Australia / Feb 2024

- Understanding the Costs of Self-Managed Superannuation in Australia / Feb 2024

- Unlocking Flexibility: A Guide to Non-Commutable Account-Based Pensions for Australians Over 60 / Jan 2024

- Empower Your Financial Journey: Why Checking Adviser Credentials Matters / Jan 2024

- Understanding the Seniors and Age Pension Tax Offset (SAPTO) / Nov 2023

- Navigating SMSF Expenses: What Your Fund Can and Cannot Pay For / Nov 2023

- Retirement Plans Change as We Age / Nov 2023

- Unlocking the Ideal Age for Retirement: A Financial Perspective / Sep 2023

- Navigating Market Volatility: The Importance of Staying Invested / Sep 2023

- The Value of Financial Advice: Navigating Challenges and Achieving Goals in the Australian Context / Sep 2023

- Unlocking Financial Clarity: The Crucial Role of Personalized Advice | Australian Finance Insights / Sep 2023

- Enhancing Financial Success: The Unseen Influence of Your Money Mindset / Aug 2023

- Closing Your Self-Managed Superannuation Fund: A Clear Guide to the Essential Steps / Aug 2023

- Maximizing Your Downsizer Contribution: Expert Insights / Aug 2023

- Empowering Future Success Through Financial Education of our Children / Aug 2023

- Maximizing Your Retirement Income with SAPTO - The Benefits of the Senior Australians Tax Offset / Aug 2023

- The Pawsitive Impact of Pet Ownership in Retirement / Aug 2023

- How can a recontribution strategy help my heirs? / Jul 2023

- How myGov Can be Used To Monitor Your Super / Jun 2023

- There is more to financial success than the numbers! / May 2023

- The Ten things you should consider when establishing a self managed super fund / May 2023

- The Importance of Patience in Share Investing: Insights from Warren Buffet / May 2023

- "When the stock market undergoes a 'correction', where does the money disapear to?" / Apr 2023

- Aussie bank hybrids vs European securities / Mar 2023

- Don't bet on the sale of your business as the only meaningful source of retirement funding? / Feb 2023

- The annual SMSF Conference held in Melbourne from February 22 - 24 2023. / Feb 2023

- SMSF and the next Gen / Feb 2023

- When it comes to the fate of your superannuation savings after you pass away, who has the final say? / Feb 2023

- Don't fear a recession / Jan 2023

- Downsizer Super contribution of $300,000 is now available to those who are over 55 / Jan 2023

- Your Golden years (The three stages of retirement) / Oct 2022

- What types of super contributions can I make? / Jun 2022

- You can borrow within your SMSF … but is it a good idea? / Mar 2022

- Digital Versus Physical Assets / Mar 2022

- The important things you need to know about sustainable investing / Feb 2022

- Closing the gender superannuation gap / Feb 2022

- Financial planning for a family member with a disability / Jan 2022

- Make 2022 a financially healthy year / Jan 2022

- 6 members allowed in SMSF from July 1, 2021. Beware of unintended consequences / Oct 2021

- The new Your Super Comparison Tool / Sep 2021

- Is the Woolworths offer reasonable for people who are retired? / Aug 2021

- Client Question... How much can we spend in retirement? / Aug 2021

- Is it possible to continue renting in retirement? / Aug 2021

- Preparing for retirement in these uncertain times / Aug 2021

- What happens when you can no longer manage your SMSF? / Aug 2021

- Investing in trends and ways to facilitate investment trends / Jul 2021

- Quarterly economic update April – June 2021 / Jul 2021

- Could an increase to your super contrubutions result in a pay cut? / Jul 2021

- The end of the financial year is upon us - have you considered... / Jun 2021

- ETFs – a real alternative to shares / Jun 2021

- Highlights of the 2021 Federal Budget / May 2021

- Extra mortgage repayments Vs. Increased Super contributions / Apr 2021

- 5 Common mistakes that could ruin your retirement / Jan 2021

- Everything you ever wanted to know about Super / Jan 2021

- 10 common financial mistakes people make before retirement / Nov 2020

- Preparing for retirement in uncertain times / Oct 2020

- Your health and wealth during the COVID-19 pandemic / Oct 2020

- Understand how uncertain times is a great time to invest with an appropriate strategy / Sep 2020

- Are you an investor or a gambler? / Sep 2020

- Are face to face meetings dying? / Sep 2020

- What happens when you can no longer manage your SMSF? / Sep 2020

- Confused by all the Superannuation jargon. We have prepared a plain English explanation of super’s most common terms. / Sep 2020

- Are you investing or gambling? / Aug 2020

- Preparing for retirement in uncertain times / Aug 2020

- The rules governing gifts from SMSFs / Jul 2020

- When a Self-managed super fund may be the wrong idea / Jul 2020

- Quarterly Economic Update: April-June 2020 / Jul 2020

- Don’t wait until your 60s to see a financial adviser / Jul 2020

- Investment Mix Available in your Super / Oct 2018

- SMSF: Administering and Reporting / Sep 2018

- A Brief background on Income Protection Insurance & Waiting Periods / Aug 2018

- 7 Tips to Maximise Your Super / Aug 2018

- Super Guarantee and Multiple Employers for highly paid employees / Aug 2018

- What is a Transition to Retirement Pension? / Aug 2018

- 2018 Budget Proposals: Increase to Number of SMSF Members / Jul 2018

- What to Know About the Pension Loan Scheme / Jul 2018

- Claiming a Tax Deduction on Personal Superannuation Contributions / Jul 2018

- Finding Lost Super / Jul 2018

- Insurance – Inside or Outside Super? / Jul 2018

- Property Investments and Your SMSF / Jul 2018

- Government Co-Contributions / Jun 2018

- SMSF Auditors: Here’s what to Know / Jun 2018

- Growing Your Superannuation / Jun 2018

- The difference between an Accountant and a Financial Planner? / May 2018

- 2018 Feeral Budget Proposals / May 2018

- I’m retired, can I make superannuation contributions? / May 2018

- Superannuation and employees / May 2018

- Introduction of Low and Middle-Income Tax Offset / May 2018

- Tips for Making Super Contributions if you’re over 65 / May 2018

- Which Superannuation fund is right for me? / May 2018

- The Age Pension: Do You Qualify? / May 2018

- Age Pension: Do You Qualify? / Apr 2018

- Bill Shorten Wants to Axe Imputation Credits / Mar 2018

- What is your Total Superannuation balance? / Mar 2018

- 5 Useful Tips for Finding a Financial Adviser / Mar 2018

- SMSF Borrowing under the LRBA: Here’s What to Know / Mar 2018

- Changes to non-concessional contribution caps / Mar 2018

- Hugo Sampson Wins 2017 Adviser of the Year Award / Mar 2018

- Changes to Personal Super Contributions Deductions / Mar 2018

- Super or Mortgage. That is the question! / Nov 2017

- Use your Superannuation to save for your first home / Oct 2017

- Super Concessions for those who are selling their home - The Downsizer Concession / Oct 2017

- LifeTime Financial Group model portfolio performance / Aug 2017

- Divorce and Superannuation. The ins and outs… / Jun 2017

- Concessional Contribution Cap reduced to $25,000 / Jun 2017

- Continued tax-free Pension Income post turning 60 whilst still employed / May 2017

- Who owns that Licence? / May 2017

- Eligibility for Spouse Contributions on Superannuation / May 2017

- Eligibility for Spouse Contributions on Superannuation / May 2017

- A comparison chart of the changes to the Superannuation contribution limits in the 2016/17 financial year. / Feb 2017

- Lowering the annual non-concessional superannuation contributions cap / Sep 2016

- Tell me more about Co Contributions / Jun 2016

- What are exchange traded funds? / Jun 2016

- Have you ever asked yourself what’s a TTR or TRIS pension? / Jun 2016

- Allocated Pensions. What are they? / Jun 2016

- What are the differences between reversionary and non-reversionary superannuation pensions? / Jun 2016

- Self Managed Super / Jun 2016

- Is a Self Managed Superannuation Fund right for you? / Jun 2016

- Pros and Cons of Self Managed Super / Jun 2016

- SuperStream / Jun 2016

- The Myth about Property Returns / Mar 2016

- Transition to retirement chatter / Jan 2016

- Understanding Hybrid Securities / Oct 2015

- Dollar Cost Averaging / Aug 2015

- Here is a sobering thought / Aug 2015

- Market Update March 2015 / Mar 2015

- Financial Planner Education Requirements Lifting - Better Late than Never / Nov 2014

- Changes to Term Deposit Arrangements in Australia / Nov 2014

- When a wake-up call makes you re-evaluate things / Sep 2014

- Topical SMSF News / Nov 2012