- Published on 24 Aug 2023

- - What is Financial Planning?, Directly Held Investment Portfolio, Investment & Financial Advice

Retirement is a well-deserved phase of life that many Australians look forward to. It's a time to relax, pursue hobbies, spend time with loved ones, and reflect on a lifetime of hard work. One of the ways the Australian government supports its senior citizens is through the Senior Australians Tax Offset (SAPTO). SAPTO is a tax offset designed to provide financial relief to eligible senior Australians, helping them make the most of their retirement years. In this article, we'll explore the benefits of SAPTO and how it can positively impact the lives of eligible retirees.

Understanding SAPTO:

SAPTO is a tax offset that aims to reduce the tax burden on senior Australians who have reached the age pension age. The eligibility criteria for SAPTO are relatively straightforward, making it accessible to a wide range of retirees. To be eligible for SAPTO, individuals must meet the following requirements:

-

Age Eligibility: You must have reached the age pension age, which is currently set between 66 and 67, depending on your birthdate.

-

Residency: You must be an Australian resident for tax purposes.

-

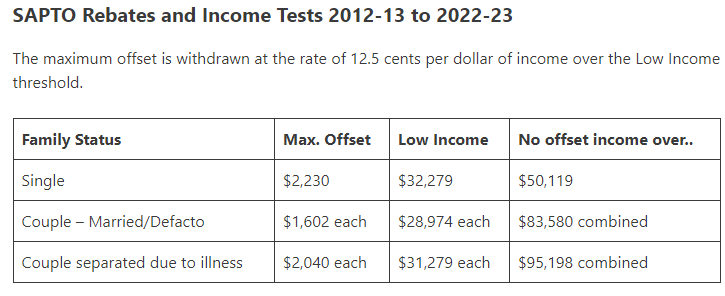

Income Limit: Your total taxable income, plus any adjusted fringe benefits and employer superannuation contributions, must fall below the specified income threshold (please note these limits apply to the 2023 financial year)

.

. -

Marital Status: Your marital status and living arrangements can also affect your eligibility and the amount of the offset you can claim.

Benefits of SAPTO:

-

Reduced Tax Liability: The primary benefit of SAPTO is its ability to significantly reduce the amount of tax you owe to the government. By applying the SAPTO tax offset to your income, you can effectively lower your taxable income and pay less tax. This can free up extra funds for your retirement lifestyle.

-

Financial Security: As a retiree, maintaining financial security is crucial. SAPTO provides a safety net for seniors with limited income by ensuring they have more disposable income available. This can ease worries about making ends meet and allow for a more comfortable retirement.

-

Increased Income: With a reduced tax liability, seniors can experience a boost in their after-tax income. This additional income can be utilized for various purposes, such as covering everyday expenses, pursuing hobbies, traveling, or supporting family members.

-

Incentive to Stay in the Workforce: SAPTO encourages some seniors to continue working, even if it's on a part-time basis. Since the offset lowers the overall tax liability, individuals can keep more of their earnings without facing a heavy tax burden, thus making it financially attractive to stay in the workforce.

-

Support for Couples: SAPTO recognises that many seniors live as couples or partners. The offset takes into account joint income and offers higher income thresholds for eligible senior couples, ensuring they can collectively benefit from the offset.

-

Simplicity: The eligibility criteria for SAPTO are designed to be straightforward, making it relatively easy for eligible seniors to claim the offset. This simplicity reduces the administrative burden and ensures that those who need the financial relief can access it without extensive paperwork.

Applying for SAPTO:

Applying for SAPTO is typically done when you lodge your annual tax return. The offset is calculated based on the information you provide in your tax return, including your income and living situation. It's essential to keep accurate records of your income sources and consult with a tax professional if you're unsure about your eligibility or how to claim the offset effectively.

In Conclusion:

The Senior Australians Tax Offset (SAPTO) is a valuable financial tool that offers a range of benefits to eligible retirees. From reduced tax liability and increased disposable income to improved financial security and support for couples, SAPTO is designed to make retirement more comfortable and enjoyable. As a senior Australian, exploring your eligibility for SAPTO and understanding how to claim it can contribute to a more fulfilling retirement journey. Remember that tax regulations and thresholds may change, so it's advisable to consult up-to-date sources or seek professional advice for accurate information.

Why not take the next step and talk to a qualified financial planner?

LifeTime Financial Group are specialist (holding appropriate accreditations) advisors who are ideally positioned to assist you with your financial planning requirements and retirement planning in particular..

If you would like to discuss your financial planning needs, why not call us today on 03 9596-7733? There is no cost or obligation for our initial conversation/meeting.

Alternatively, please make an appointment using our online Book an appointment (Blue button above)

LifeTime Financial Group. A leading privately-owned Melbourne-based Financial Planning practice with no ties to any financial institution.