- Published on 28 Oct 2025

- - What is Financial Planning?, Investment & Financial Advice, Superannuation

The risk of trying to time the market — and why it matters

Investing for the long term can feel like navigating a storm: you know the horizon looks promising, but the waves can be uncomfortable. It’s especially tough when the market dips and you’re tempted to sit on the sidelines. The truth is, stepping away at the “wrong” time can be more costly than staying the course.

Why staying invested matters

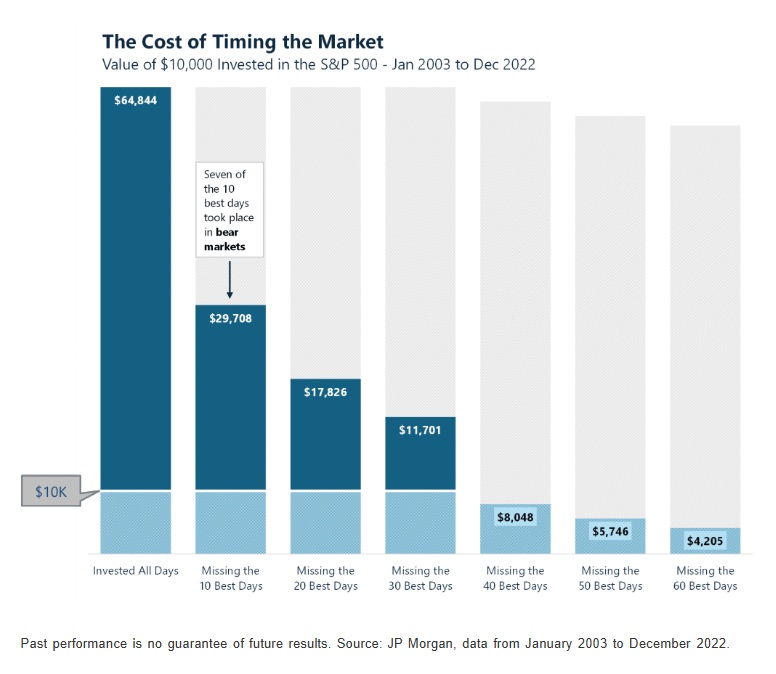

Consider this real-world illustration. Suppose you invested US$10,000 in the S&P 500 and simply left it untouched for 20 years. The final value? Around US$64,844.

Now imagine that you missed just the market’s 10 best days in that same period — you’d end up with roughly US$29,708. Miss 60 of those best days, and your final amount would shrink to around US$4,205.

This chart clearly shows how missing a handful of high-growth days can dramatically affect long-term returns.

What this means for Australian investors

Here in Australia (and globally), market dips are part of the journey. While it’s natural to feel uneasy when markets fall, the opportunity cost of not being invested can be far greater than the emotional discomfort of short-term volatility. Armed with a well-designed long-term investment plan — one matched to your time-horizon, goals and risk profile — staying invested makes sense.

Why market timing is so difficult

There are three critical hurdles when trying to time the market:

- Deciding when to exit: You see the market slipping and think it’s time to pull out.

- Getting back in at the right moment: Even if you’ve exited at the “right” time, re-entering when the market turns around is challenging.

- Coping with unpredictable rebounds: Many of the market’s strongest days happen right after big losses. For instance, one analysis found that several of the 10 best days in recent decades took place immediately after the worst days.

In short: to time the market successfully, you’d essentially need to nail both the exit and the re-entry — repeatedly. The odds aren’t in your favour.

Better options for long-term investors

If timing the market is a high-risk strategy, what’s a more reliable path? Here are a few firmer steps for the patient investor:

- Stick to a disciplined, well-diversified portfolio aligned with your goals and risk tolerance.

- Focus on time in the market rather than perfect timing of the market.

- Resist letting short-term volatility derail your long-term plan — the value you might miss by stepping out can be substantial.

- Review your strategy regularly (but avoid reacting to every headline). A financial adviser can help you stay the course when emotions rise.

Final word

For long-term investing success, the most valuable question is not “When should I try to get out of the market?” — but rather “How do I stay invested and trusted to ride the journey over years?” The chart above speaks volumes: staying invested through the highs, lows and everything in between is often the smarter path.

As always, past performance isn’t a guarantee of future results. But staying invested, aligned with your strategy, offers you the best chance of capturing those meaningful moments in the market that power long-term growth.

Why not take the next step and talk to a qualified and highly experienced financial planner today?

LifeTime Financial Group are specialist (holding appropriate accreditations) financial planners who are ideally positioned to work with you in planning and managing your investment needs. Based in the Brighton in Melbourne's bayside area, we are ideally located with easy parking and proximity to everything the basyide area has to offer.

If you would like to discuss your current position or wider financial planning needs, why not call us today on 03 9596-7733? There is no cost or obligation for our initial conversation/meeting.

LifeTime Financial Group. A leading privately owned Melbourne-based Financial Planning practice with no ties to any financial institution.